This section encompasses a wide range of GVC related information:

- ‘Events’ captures activities such as speeches and moderations at conferences and symposiae and, moreover, the appearance at/participation in any such events.

- ‘News’ captures all occurences relevant in the context of GVC’s business not qualifying as an ‘Event’ but worth sharing.

Amsterdam, 03 May 2023

Wolfgang attended the FLAME Gas Conference in Amsterdam on 03 May 2023, where he chaired the afternoon session of ‘Stream B’, titled: “GAS SUPPLIES & PRICES TO EUROPE”

The session started with a Fireside chat titled “Diversification and fostering alternative supply routes: replacing Russian gas and hitting 2030 targets”. The chat was moderated by Alexis Foucard, Counsel at Clifford Chance. The participants were Botond Feledy, Foreign Policy Expert at the CEID and Iryna Sereda, Head of European Gas at Bloomberg NEF.

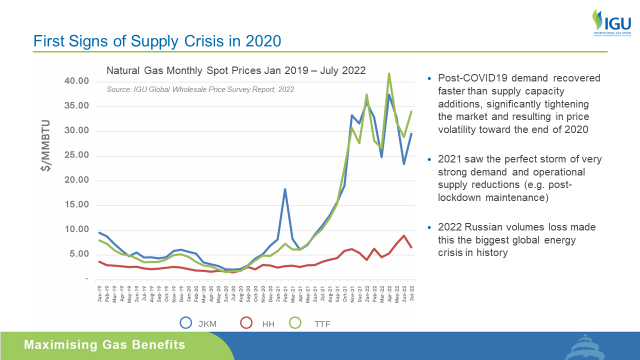

The next session featured a presentation titled “Security of supply and global markets update”, given by Tatiana Khanberg, Director Strategic Communications and Membership of the International Gas Union (IGU). I.a., Tatiana pointed out that, since 2016, global oil and gas investments had almost halved, causing supply tightness. While 2020 saw extreme volatility in conjunction with the pandemic, the faster than expected recovery saw excessive price hikes in 2021. Those were exacerbated by the Russian invasion in 2022, making this the biggest global energy crisis in history.

Tatiana also emphasized that the rise of gas-on-gas pricing in global LNG had fostered a global gas market which was key to redirect LNG trade flows substituting the failure of Russian supplies by European price signals.

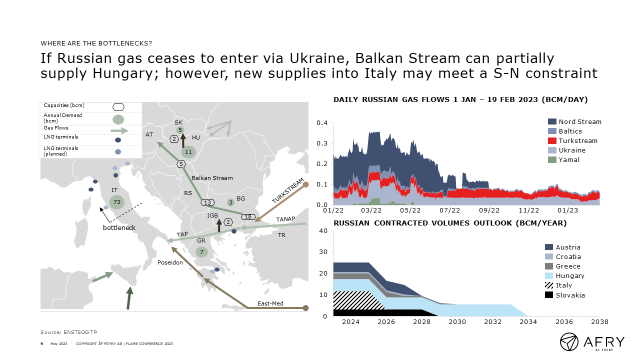

The following session featured a presentation titled “New routes for gas through Europe”, given by Lucy Field, Senior Gas Market Expert at AFRY. Lucy emphasized the routes crucial for the redirection of trade flows after the cessation of major portions of Russian supplies: (i) Balkan Stream (via Turkstream, which continues to deliver Russian gas to Europe, e.g. Serbia, Hungary), (ii) the envisioned TAP expansion aiming to bring in East-Med supplies via the envisioned EastMed/Poseidon pipeline and (iii) new LNG into Germany.

Lucy pointed out potential bottlenecks if the already diminished quantity of Russian gas would cease to flow via Ukraine: Hungary could partially be supplied via Balkan Stream, but there might be constraints to supplies via Italy. As to the various German FSRUs, envisioned to be replaced by land-based terminals, Lucy identified a constraint in the pipeline capacity West to East, in the North of Germany, potentially constraining gas flowing from the terminals on the German North West Coast onwards to Czechia, Slovakia and Hungary.

The last session was a panel titled “Ukraine’s gas & LNG markets”. The panelists were Willem Copoolse, Group Director at ERU, and Gregor Weinzettel, Gas Expert at the Energy Community Secretariat. The panel was moderated by Wolfgang, who also invited Lucy Field to join the panel. The discussion amongst the panelists was complex, since the situation had to be divided into ‘technical support rescue’ operations in conjunction with the deliberate destruction of critical Ukrainian infrastructure, ‘re-building’ after the war and future prospects for Ukraine to become part of the single European gas market. Two important aspects are noteworthy: Ukraine’s huge potential regarding storage services and its significant upstream potential (which had in the past been stifled by corruption) such that Ukraine could even become a net-exporter of gas.

Berlin, 23 and 24 November 2022

Wolfgang participated in the “German-Polish Energy Dialogue”, organized by ‘Stiftung Wissenschaft und Politik’ (‘ SWP’) in cooperation with the Polish Institute of International Affairs (‘PISM’). The conference took place on 23 and 24 November 2022 in Berlin.

Since Chatham House rules apply, the contents of the lively debate cannot be shared. It appears fair to say that all participants were deeply shaken by the criminal invasion of Russia into Ukraine and determined to support Ukraine by all possible means.

Wolfgang delivered, under the panel heading “Security of gas supply in the coming winter: chance for cooperation” a presentation titled “Observed solidarity shortfalls: Ideology & Selfishness”, in which he brought forward a couple of observations on solidarity shortfalls in a variety of countries: First Germany, which subsidizes its citizens with € 200 billion, but is hampered by ideology to alleviate the supply shortfalls of both gas and electricity by mobilizing indigenous resources in ‘Kriegsmangelwirtschaft’ fashion. Rather, it selfishly relies on imports from neighbors (e.g. nuclear power from France). Also The Netherlands were criticized for keeping the lid on the huge Groningen gas field for mostly ideological reasons. Moreover France for derailing the – in planning far advanced – MidCat pipeline between Spain and France. Poland for booking capacity at the Lithuanian Klaipeda LNG terminal and transporting the gas into its own market instead of making it available in the Baltic region where it is badly needed.

The Hague, 08 September 2022

Wolfgang participated in the “CIEP Gas(es) Day”, organized by the ‘Clingendael International Energy Programme’ (‘CIEP’) on 08 September 2022 in The Hague.

The conference aimed to address two topical subjects: the development of the international gas market in a less harmonious world and the impact on the NW European and German gas market and the prospects for low carbon hydrogen in NW Europe going forward.

Wolfgang delivered a presentation titled “Between a Rock and a Hard Spot. The German ‘Energiewende Bullerbü’ confronted with global gas market (and European power market) realities” in which he strongly criticizes the German government (and others) for pretending the price hike in electricity and gas was ‘only temporary’ and would shortly disappear. He pointed out that both the power and the gas price hikes started already in 2021, admittedly exacerbated by the Russian war, but not the true root cause. Read moreThe pre-war root cause for the high gas prices was i.a. a supply shortfall, which could be alleviated by extracting the huge German indigenous gas resources by environmentally friendly fracking and ramping up the Groningen gas field production. The accelerated construction of LNG terminals would by no means alleviate the high gas prices, since Europe was now in permanent price competition with Asia about LNG. The root cause for the high power prices was also a supply shortage created by taking offline nuclear and coal-fired power generation and, at the same time, increasing demand by e-mobility, heat-pumps and electrolysis. The accelerated construction of wind and solar would by no means alleviate the high power prices, since featuring only a secure load of 1% of the name plate capacity, thus continuing to require 99% back-up by gas-fired power generation.

Berlin, 01 and 02 September 2022

Wolfgang participated in the “Expert Talks on Global Energy Markets”, organized by ‘Stiftung Wissenschaft und Politik’ (‘ SWP’) in cooperation with the World Energy Council. The conference took place on 01 and 02 September 2022 in Berlin.

Since Chatham House rules apply, the contents of the lively debate cannot be shared. It appears fair to say that all participants were deeply shaken by the criminal invasion of Russia into Ukraine.

Naturally, one of the dominating subjects was security of gas supply absent Russian supplies.

Wolfgang delivered a presentation titled “Are we sleeping at the wheel?” in which he strongly criticizes the German government (and others) for assuming the price hike in electricity and gas was ‘only temporary’ and would shortly be resolved. He pointed out that both the power and the gas price hikes started already in 2021, admittedly exacerbated by the Russian war, but not the true root cause. The true root cause for the excessively high prices in both gas and electricity is a supply shortfall.

The thoughts developed for the SWP presentation shall come back in more refined fashion in a number of event presentations and publications.

Amsterdam, 03 and 04 May 2022

Wolfgang attended the FLAME Gas Conference in Amsterdam on 03 and 04 May 2022, where he moderated a panel:

The panel was titled ‘Trading in the Baltics and CEE in times of high prices and extreme volatility exacerbated by uncertainties of Russian gas flows’ and sub-titled ‘Impact of high prices and extreme volatility on trading; Situation in Ukraine and adjacent countries; How would the Baltics and CEE cope with the cessation of Russian gas flows; Prospects for future trading with less (if any) Russian pipeline gas; Which additional supply sources can we expect to retain liquidity?‘ The panelists were Gintaras Buzkys, Chief Business Development Officer, GET Baltic; Volker Lauer, Gas Origination East, RWE Supply & Trading; Gottfried Steiner, CEO, Central European Gas Hub and Lisse Geert van Vliet, Business Developer, Ukrainian Energy Exchange.

As always, no individual presentations by the panelists were given, but Wolfgang steered the dialogue via illustrative background slides.

While the illegal Russian invasion into Ukraine had already begun, Russian gas flows at the time of the conference had remained relatively stable. Nonetheless, the war had further exacerbated the global gas price hike already seen in 2021. A major concern was the exponential increase in collateral and its potential impact on trading liquidity. Moreover, all manner of discussions transpired as to what could be done in the event of either Russian gas curtailments and/or European sanctions on Russian gas supplies. Read moreVolumes via the Southern Corridor were too small to make a difference. The much discussed East-Med supplies were apparently slow in coming and the Black-Sea discoveries far from being ready for market. A positive note came from GET Baltic: With the inception of the Baltic-Connector between Finland and Estonia Finland was no longer a single source dependent island.

Schwerin/Friedrichskoog, 01 February to 1 March 2022

Wolfgang accepted the invitation of the Chairman of Nord Stream 2 AG to become member of the supervisory board of ‘Gas4Europe’ (‘G4E’) residing in Schwerin as of 01 February 2022. Upon an extraordinary supervisory board meeting on 01 March 2022, Wolfgang tendered his resignation from such office as a reaction to the inexcusable and illegal invasion of Russia into Ukraine.

G4E was the German subsidiary of Nord Stream 2 necessary to be established for the last some 50 km of the more than 1.200 km Nord Stream 2 pipeline straddling German territorial waters. While in the face of the inexcusable criminal acts of Putin ‘water under the bridge’, it remains worthwhile recalling that this was yet another discriminatory action directed solely against Nord Stream 2, since no other import pipeline (be it Norwegian, Dutch, Algerian or other) ever required a German subsidiary.

Wolfgang’s motivation to support Nord Stream 2 was, as explained frequently, the environmental benefit of the lowest full value chain CO2 emissions of gas transported through Nord Stream 2 and its hydrogen readiness. All such support of course shattered by Putin’s criminal acts.

Wolfgang’s decision to resign was also covered in the press, not least with a slap towards a certain individual in Hanover not showing the same consequential behavior.

Amsterdam, 02 and 03 November 2021

Wolfgang attended the FLAME Gas Conference in Amsterdam on 02 and 03 November 2021, for the first time since 2019 again in person. He moderated two panels:

The first panel was titled ‘THE vs TTF vs rest of Europe: With The Netherlands transitioning out of natural gas, can Germany (will it want to?) supplant TTF? Update on European Hubs – how far away are we from a European Henry Hub?’ The panelists were Frank van Doorn, VP Head of Business Unit Trading, Vattenfall, Pierre Cotin – Chief Commercial Officer, GRTgaz and Marcel Steinbach, Head of Energy Trading, BDEW. As always, no individual presentations by the panelists were given, but Wolfgang steered the dialogue via illustrative background slides.

After the two remaining trading hubs in Germany (NCG and Gaspool) were merged into one hub with the ambitious name Trading Hub Europe (THE), one of the main questions was whether THE would supplant the Dutch TTF.

It became apparent that the Dutch TTF remains clearly in the lead in terms of liquidity and transaction volume, not least since the TTF has firmly established itself as a European and also global price marker, on the latter also for financial hedging of LNG.

According to ACER’s most recent Market Monitoring Report, the divergence of European markets from the TTF price level benchmark has further improved, i.e. the European gas market is well on its way towards a European Henry Hub.

The second panel was titled “Going East: How is Eastern Europe influenced by changing Gas Flows? – Consequences of changing gas flows in Eastern Europe; Development of traded gas markets.” The panelists were Gintaras Buzkys, Chief Business Development Officer, GET Baltic, László Fritsch, CEO, MVM CEEnergy, Hungary, Volker Lauer, Gas Origination East, RWE Supply & Trading and Gottfried Steiner, CEO, Central European Gas Hub. As always, no individual presentations by the panelists were given, but Wolfgang steered the dialogue via illustrative background slides.

Significant changes in gas flows have transpired through the start of operations of the Russian Turkstream pipelines and the completion of the Finland-Estonia interconnector, with more to come once the Nord Stream 2 pipeline becomes operational. Read more

It became apparent that especially Hungary, with interconnections to six neighboring countries, bears huge potential for cross-border trade by means of physical and/or virtual reverse flow. The Baltic region has transformed into one market area, thanks to the interconnector now also including Finland. Only Poland sits like a cork in the bottle preventing this region from becoming part of the Northwest-European hubs, which have successfully been acting ‘as a transnational market behaving like a single price zone’ (P. Heather) for a while.